Macro Views – Markets, Supply Chain, and Policy – How we are thinking about the convergence of these trends

Recent macro developments related to the markets, geopolitics, policy, and the unfolding energy transition have converged to strengthen the unfolding tailwinds for lithium and KMX’s core business.

Recently, we have received more questions about how these trends, as well as issues relating to global supply chain and the EV and battery re-shoring efforts impact the outlook for KMX.

For this month’s update, we provide some high-level thoughts on these macro trends and how KMX is uniquely positioned for the unfolding multi-decade lithium investment upcycle.

For next month’s update, we expect to provide an update on customer demonstrations, new technology initiatives, and highlight some exciting corporate and commercial partnerships.

Strong Lithium Outlook Outweighs Short-Term Market Volatility

Persistent inflation pressures, driven by supply chain challenges and high energy costs, are driving interest rates globally and affecting markets. Various investment banks and economists are forecasting a looming recession as a result, albeit mild.

However, the long-term tailwinds for the energy transition (and underlying demand for lithium) are only strengthening, particularly following the recent oil & gas market disruptions.

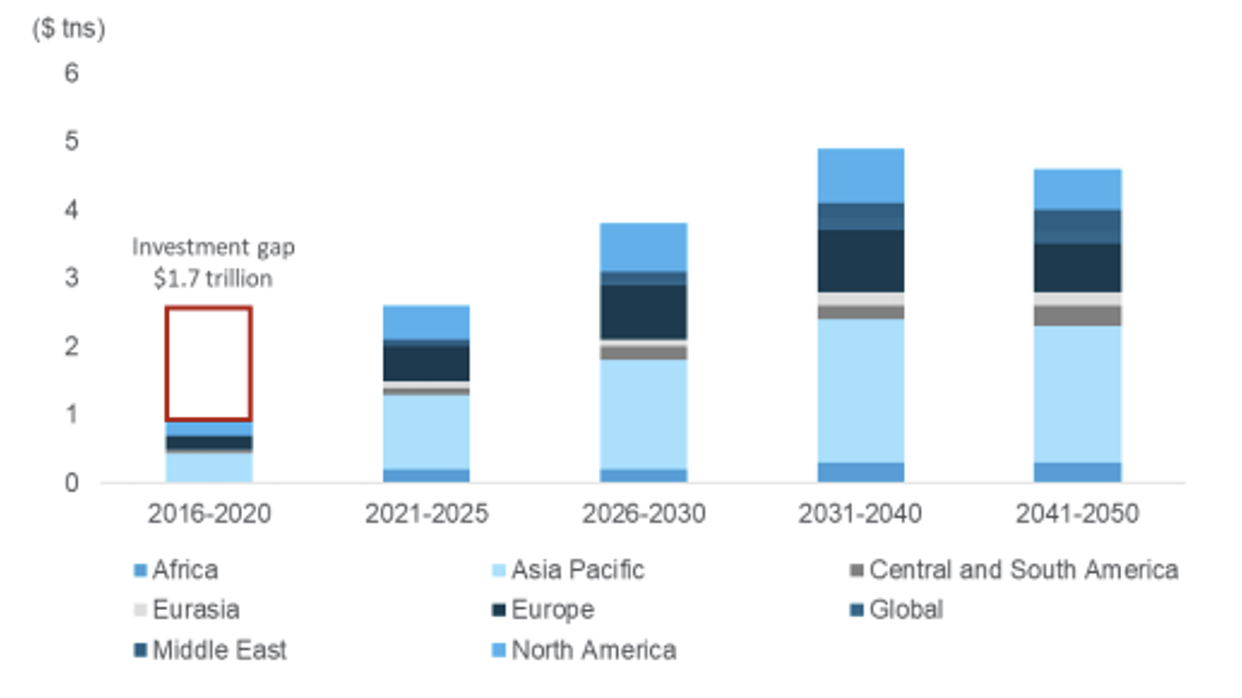

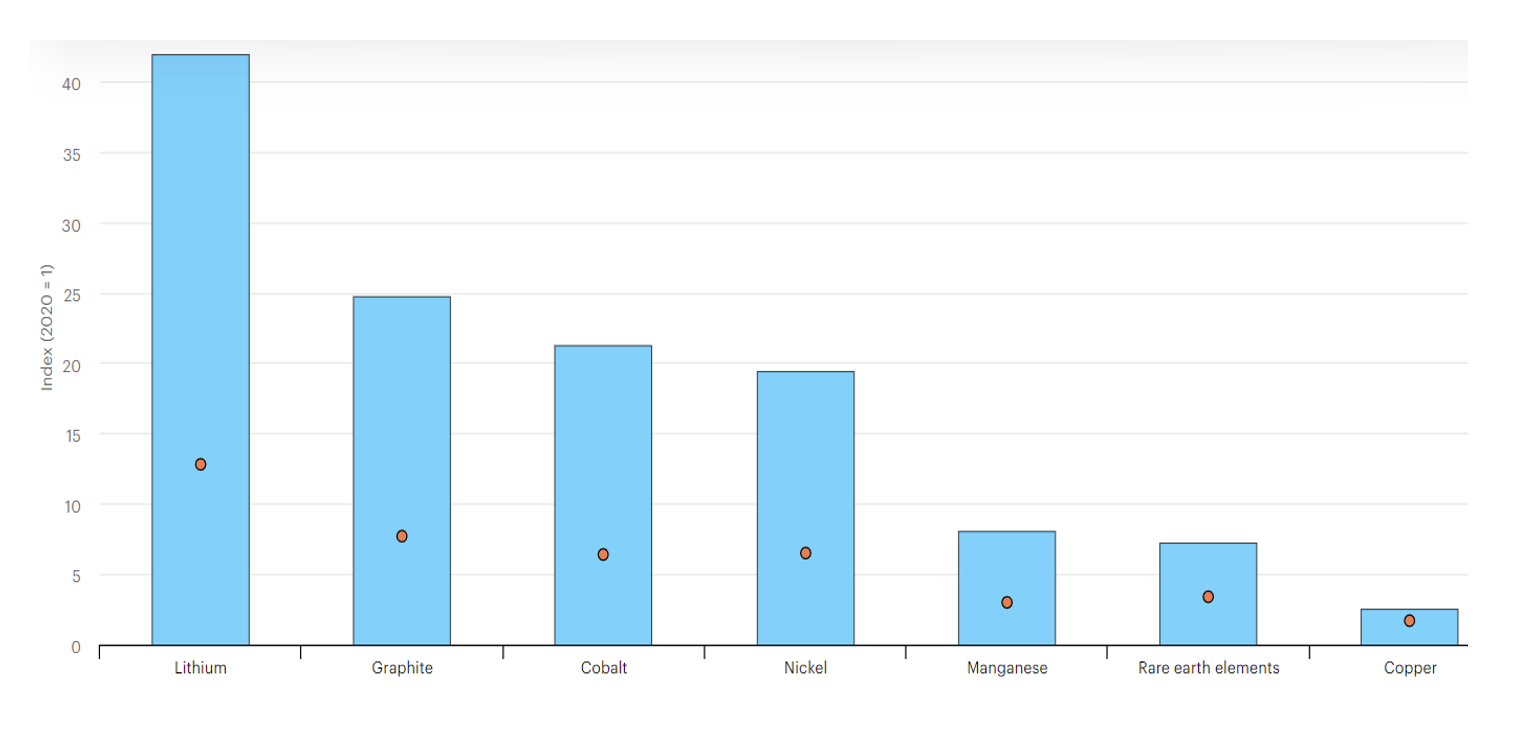

As a result, significant investment is expected for the energy transition and to meet the 13-42x increase in lithium demand by 2040, as highlighted in Figures 1 and 2 below.

Figure 1: Climate Finance Investment Outlook Source: Citii Source: Citii |

Figure 2: Critical Mineral Outlook to 2040 Source: IEAii Source: IEAii |

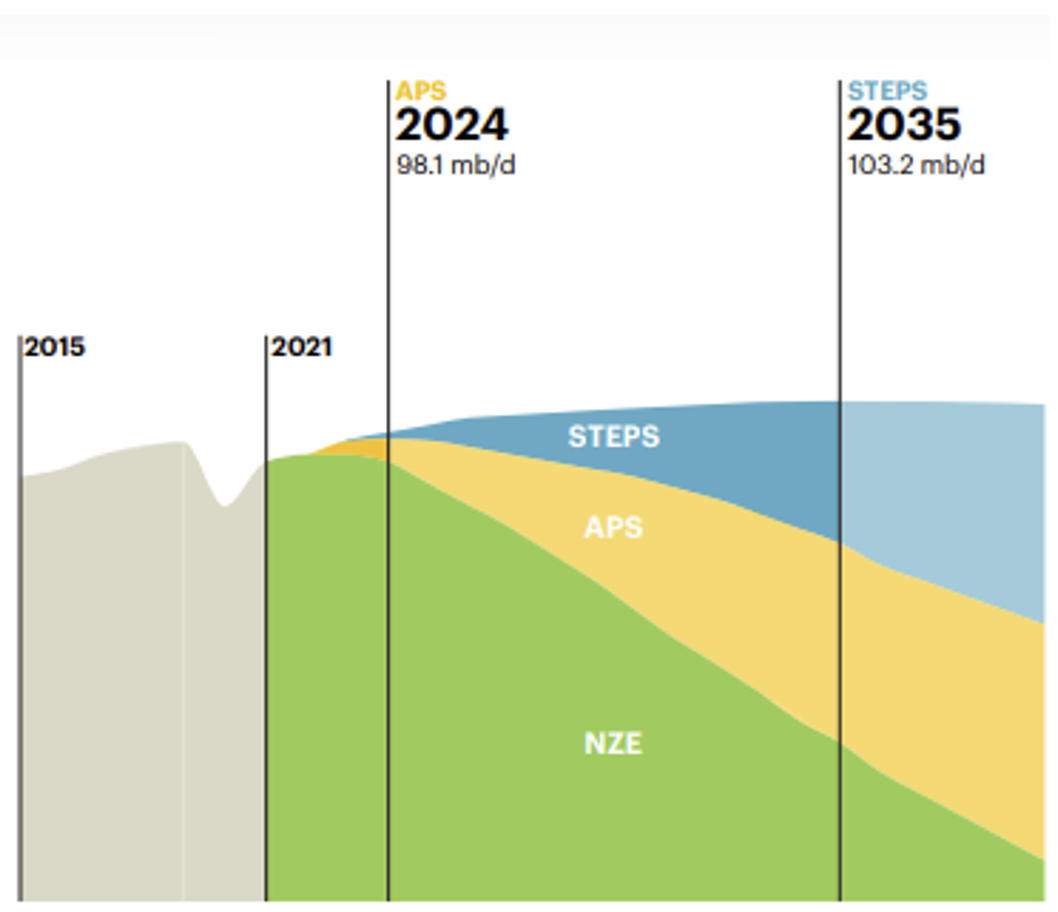

The multi-decade investment upcycle in lithium coincides with an expectation that oil demand is entering terminal decline, as forecast by the IEA in Figure 3 below.

While the oil & gas market is expected to remain sizeable in the coming decades, investors have shifted interest company growth to returning capital to shareholders, which should keep traditional energy prices elevated for the near-to-medium term (further reinforcing the shift to EVs).

KMX recently licensed its technology to TETRA Technologies for exclusive use in the oil & gas industry globally for the purpose of treating produced water for beneficial reuse, representing an exciting growth opportunity in a mature market looking for sustainable solutions.

Figure 3: Global Oil Demand Scenario Outlook  |

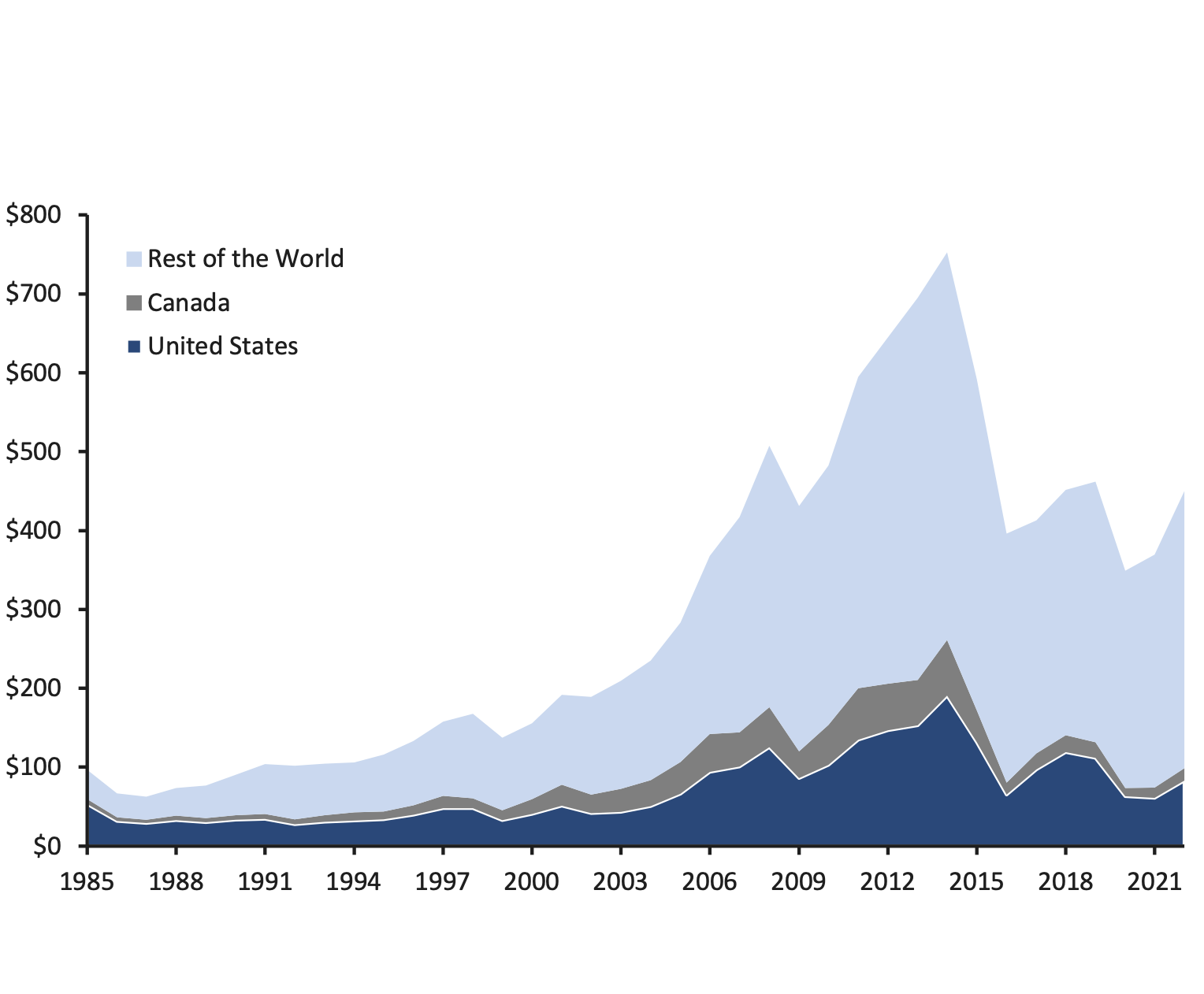

Figure 4: Global E&P Spending, 1985-2022E ($B) |

| Source: IEAiii | Source: Evercore ISI |

This expectation is driving underinvestment in oil & gas, a focus on returning capital to shareholders, and should keep traditional energy prices elevated for the near-to-medium term (further reinforcing the shift to EVs).

Long-term lithium outlook could strengthen during broader market downturn

In addition to the robust long-term demand outlook for lithium, further market softening could bring additional support for EV infrastructure and lithium.

For example, according to Citi, “EVs and related infrastructure are likely to be one of the first sectors to be stimulated in the case of a regional or global recession (which may result from high energy prices in part from the Russia-Ukraine conflict)” iv

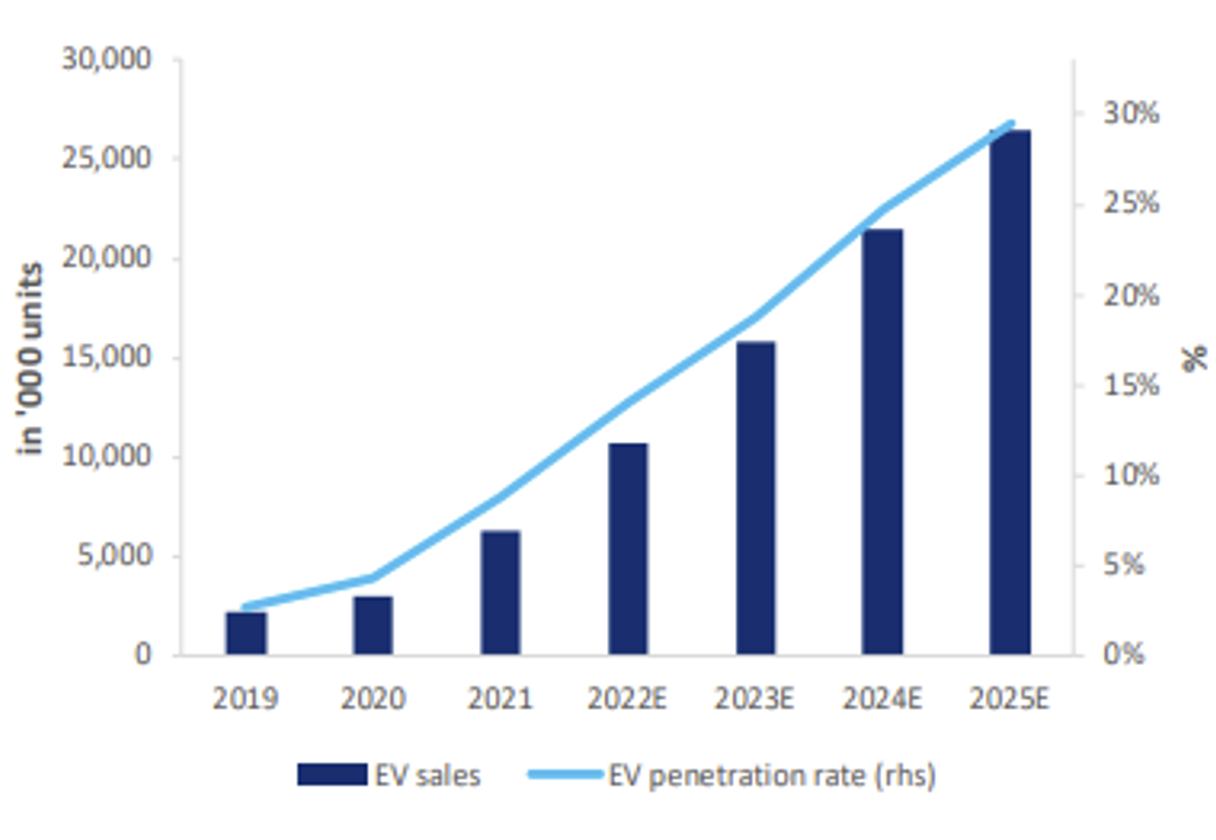

Figure 5: Global EV Outlook to 2025 Source: Citiv Source: Citiv |

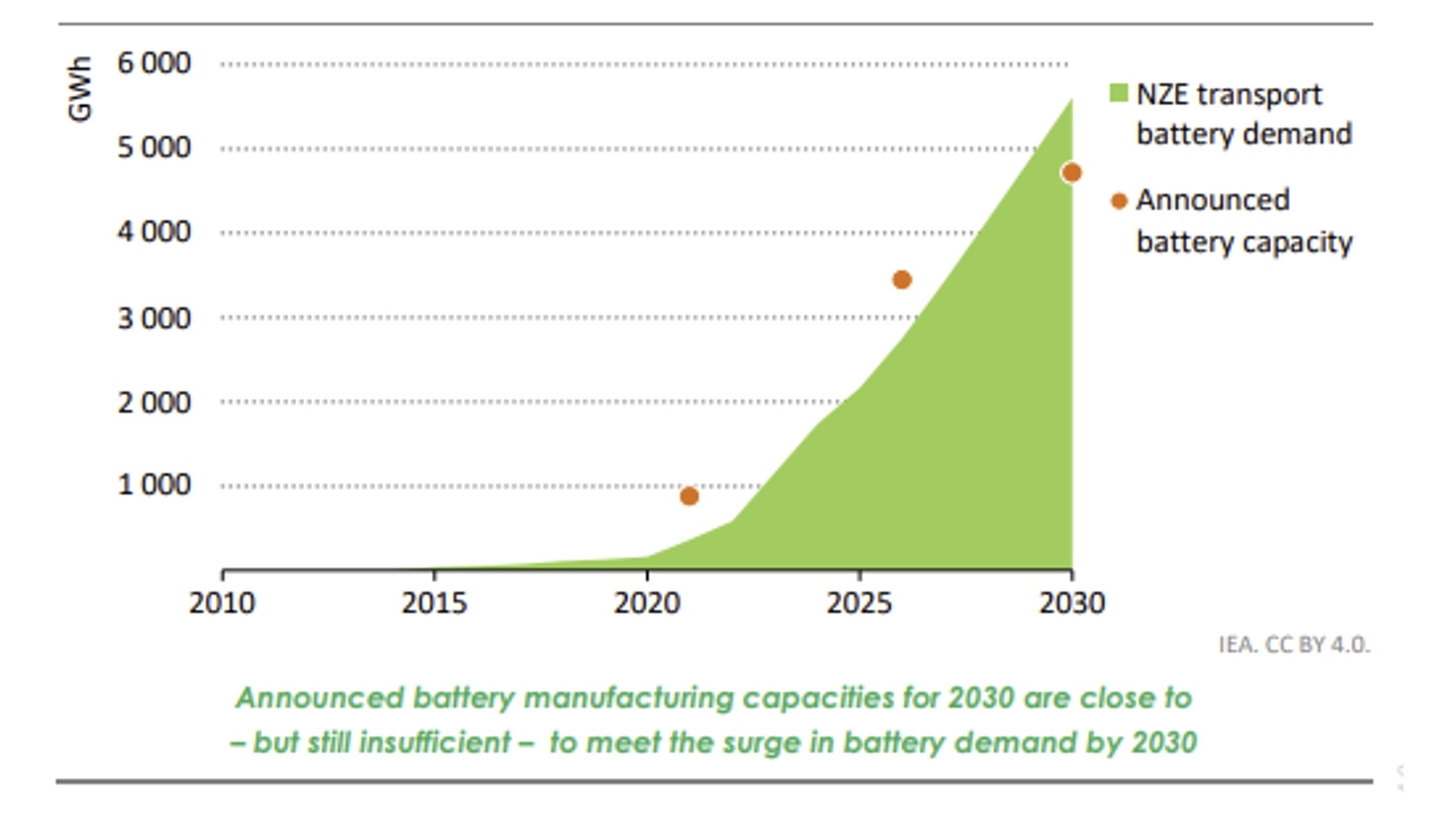

Figure 6: Battery Capacity and Demand Outlook Source: IEA, Benchmark Mineral Intelligence vi Source: IEA, Benchmark Mineral Intelligence vi |

As a result, while we remain cautious about the broader economic environment in the near-term, the long-term outlook for lithium and the energy transition is only improving and we expect this trend to continue, if not accelerate. KMX is well positioned as a result.

Hard Tech in Focus

Another major unfolding theme that benefits KMX is the emerging focus on hard tech, “which is poised to disrupt a wide range of traditional industries”, according to Barclays.

KMX’s underlying technology was developed over a 15-year period and continues its disruptive path, as highlighted in Figure 7 below. Our technical team is focused on extending our leadership position.

KMX’s powerful, cross-cutting technology is poised to displace traditional brine concentration offerings, such as mechanical evaporators and mechanical crystallizers, which carry higher capital costs, energy costs, carbon intensity, and have inferior water recovery capabilities (for quantity and quality).

Figure 7: KMX Gen III Membrane Development Path

Source: KMX Technologies, LLC

Reshoring Manufacturing for Critical Industries

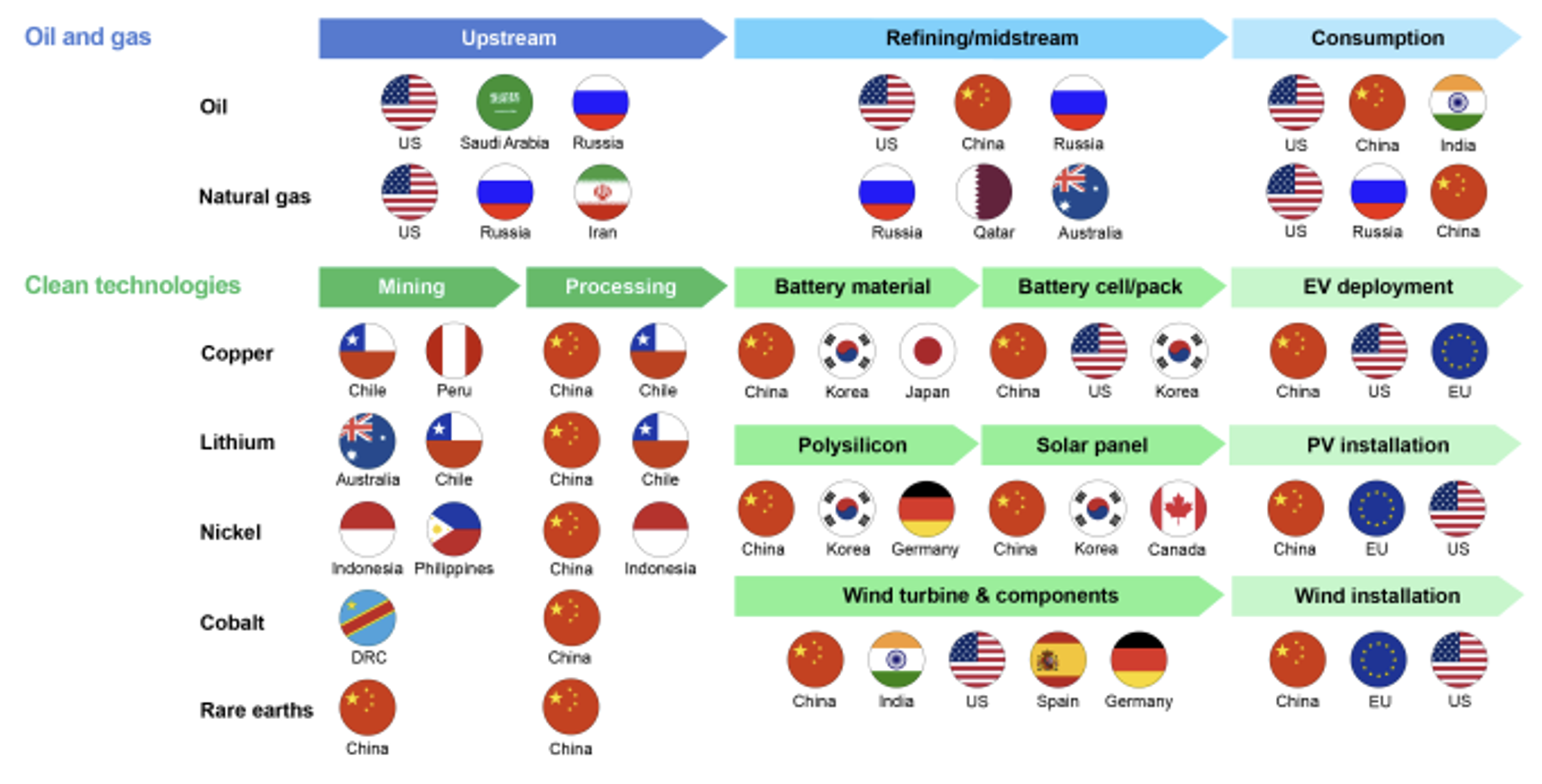

Advances in automation, manufacturing, material science, and other industrial disciplines have converged with the recent emergence of supply chain security concerns and western efforts around reshoring manufacturing for critical industries, such as automotives, chip-manufacturing, and clean technologies.

The lithium and battery value chain, strategic sectors of geopolitical importance, should benefit from these unfolding value-added manufacturing efforts and western reshoring initiatives.

We believe KMX is uniquely positioned to benefit as the multi-decade lithium investment upcycle incorporates next generation technologies that are the most cost competitive, environmentally conscious, and deliver modular scalability to ensure a fragmented and geographically diversified lithium supply chain.

Figure 8: Traditional and New Energy Supply Chain Concentration by Country

Source: IEAvii

Repositioned Hard Tech for Lithium Concentration

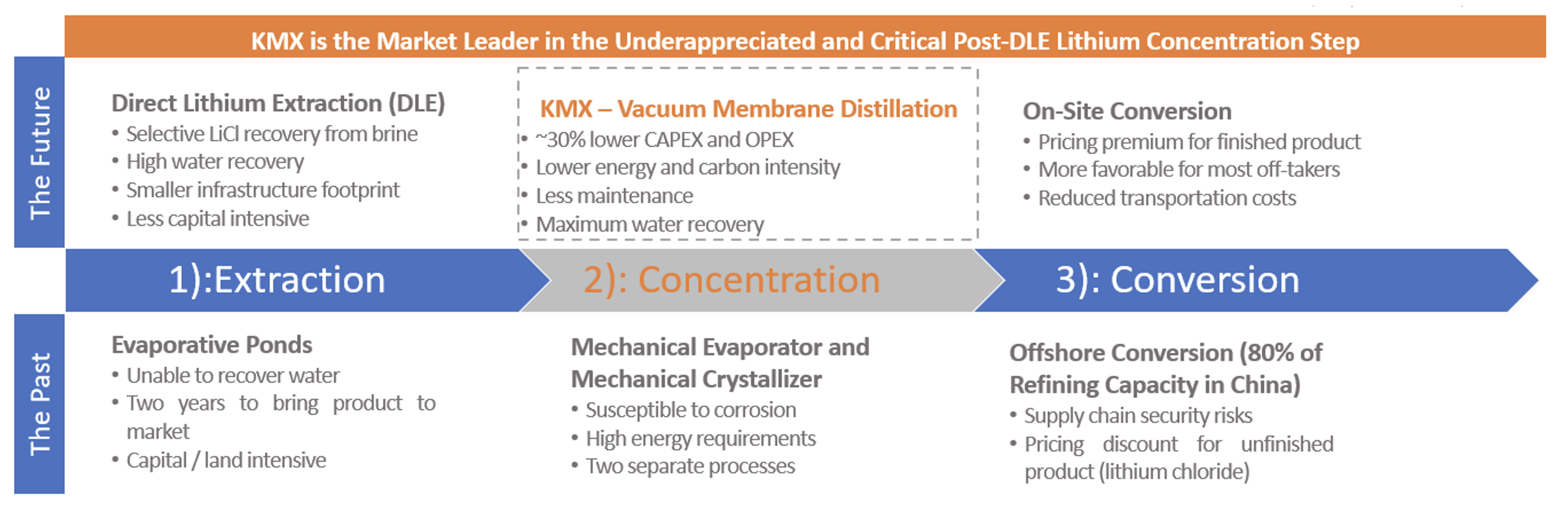

KMX’s cross-cutting technology, which was developed for desalination and brine concentration, has been repositioned for the booming lithium sector, which requires lithium found in its natural state (lithium chloride) to be concentrated to high levels before it is ultimately converted to battery grade lithium (lithium carbonate or lithium hydroxide), as illustrated in Figure 9.

As part of the lithium concentration process, KMX’s unique vacuum membrane distillation technology also maximizes recovery, versus the alternative solution where substantial amounts of lithium can be lost in the evaporation process.

Figure 9: Three-Step Process for Bringing Lithium from Brines to Battery-Grade Lithium

Source: KMX Technologies, LLC

Policy – Favorable Funding Environment; Building on Recent Canadian Government Grant

Lastly, we expect the wave of policy support for the proliferation of EVs and advanced critical mineral technologies to continue.

KMX is honored to have been chosen as the lithium concentration partner to the leading Canadian government natural resource research institution, Natural Resources Canada (NRCan), in their efforts to optimize the three-step lithium development process (shown above in Figure 9).

The funding comes from the Federal Research and Development component of the Canadian government’s $47.7 million Critical Minerals Research, Development, and Demonstration Program, and significantly supplements KMX’s R&D and laboratory budget.

While we are primarily focused on executing for our current customer base and expanding our commercial pipeline, we anticipate applying for select additional government funding opportunities in the future.

Inflation Reduction Act to Accelerate Energy Transition

More broadly, we expect funds unlocked by the Inflation Reduction Act (IRA) to accelerate the energy transition and proliferation of KMX’s technology. The IRA encourages the domestic buildout of critical mineral and EV supply chains and should exacerbate the reshoring and advanced manufacturing trends.

Automotive electrification is expected to accelerate as a result of the IRA, with the IEA estimating annual U.S. EV sales of 30% by 2030, up from 5% today.

We believe the U.S. is poised to be a leading lithium producer with a number of large-scale lithium projects in resource-rich basins, like TETRA Technologies’ lithium development project in Arkansas.

Further, we anticipate a significant amount of lower concentration lithium sources in the U.S. will be developed as Direct Lithium Extraction (DLE) technology improves and as lithium-rich produced water from oil & gas production is unlocked.

Up Next

We have a number of exciting developments unfolding, including commercially, operationally, and on the corporate level.

While the commercial team is spending more time with our existing customers, it is evaluating some unique lithium opportunities and also thinking about new markets for the future.

Operationally, we have commenced preparations for a new lithium customer demonstration, are preparing for various field demonstrations in 2023 with our mobile treatment unit, and continue to work with our key strategic suppliers and manufacturers, like Sumitomo Electric, for commercial-scale systems.

On the corporate level, much of my time is being spent evaluating exciting potential partnerships, including joint ventures, project finance development partnerships, and other partnerships to proliferate our powerful cross-cutting technology.

We look forward to hopefully sharing more details on these updates and more in the coming months!

— Zac

Zachary Sadow

CEO

KMX Technologies

i Citi GPS, “Climate Finance”, November, 2022, Available from: CLIMATE FINANCE: Mobilizing the Public and Private Sector to Ensure a Just Energy Transition – Nov. 2022

ii IEA, “The Role of Critical World Energy Outlook Special Report Minerals in Clean Energy Transitions – Executive Summary”, March, 2022, Available from: Executive summary – The Role of Critical Minerals in Clean Energy Transitions – Analysis – IEA

iii IEA, 2022 World Energy Outlook, October, 2022, Available from: IEA World Energy Outlook – 2022. Note: Stated Scenarios include Policies Scenario (STEPS), Announced Pledges Scenario (APS), and Net Zero Emissions by 2050 (NZE) Scenario

iv Citi GPS, “Energy Transition – Vol. 1”, November, 2022, page 63Available from: Citi GPS – Energy Transition, Vol. 1 – Nov. 2022

v Citi GPS, “Energy Transition – Vol. 1”, November, 2022, Available from: Citi GPS – Energy Transition, Vol. 1 – Nov. 2022

vi IEA, 2022 World Energy Outlook, IEA analysis and Benchmark Mineral Intelligence, October, 2022, Available from: IEA World Energy Outlook – 2022. Note to figure 4: Battery demand growth in transport in the NZE (net zero emissions by 2050) Scenario and announced battery manufacturing capacity expansion, 2010-2030

vii IEA, “The Role of Critical Minerals in Clean Energy Transitions”, March 2022, Available from: The Role of Critical Minerals in Clean Energy Transitions, March 2022