Scotiabank energy analyst, Paul Cheng, recently hosted KMX for a discussion on the multi-faceted oil & gas opportunities presented by our cross-cutting technology.

It was a timely discussion as seismic activity has significantly increased in the Permian Basin, strengthening the drive by regulators and operators to find alternatives to injecting produced water into saltwater disposal wells (SWDs), which has been shown to induce earthquakes.

KMX recently licensed its technology to TETRA Technologies for beneficial reuse of produced water for oil & gas, providing an alternative to SWDs. KMX is also the water management partner for Meridian Energy Group, which is developing a next generation refinery in North Dakota.

My conversation with Paul also highlighted how our technology presents traditional energy companies the opportunity to participate in the energy transition by concentrating lithium chloride found in produced water to economically extractable levels.

In this update, we dive deeper into: 1) beneficial reuse, 2) the growing seismicity concerns from SWDs, 3) the opportunity to monetize lithium-rich produced water, and 4) KMX for refining.

Beneficial Reuse Presents Significant Opportunities

Beneficial reuse (recycling produced water, which is a mineral-rich byproduct of oil & gas production, for use outside the oilfield) has been steadily garnering more attention over the past few years as regulators and operators look to find alternatives to SWDs.

The market opportunity for beneficial reuse in the U.S. alone is significant, as nearly 23 billion barrels of produced water was estimated for 2022, with over 56% of this amount going to SWDs, according to Rystad Energy Research.

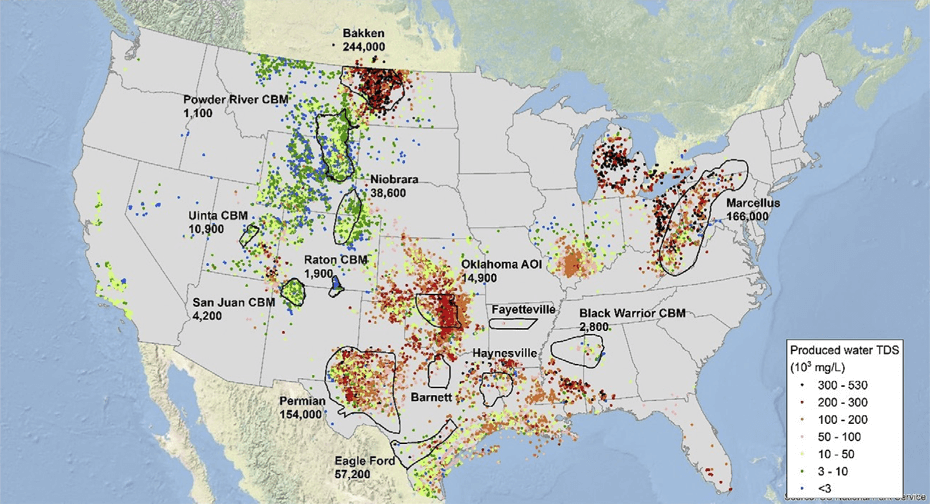

We expect this number to increase, particularly in hard-to-treat high total dissolved solids (TDS) markets which are poised for additional growth, like the Permian, Haynesville, and Appalachian Basins, among other key U.S. oil & gas producing basins.

Figure 1: Highest producing and highest growth basins (Permian, Bakken, Marcellus) are high TDS

Source: Scanlon et al, 2020

TETRA Technologies is well positioned to proliferate KMX’s powerful technology in the global oil & gas industry. TETRA has operations spanning six continents, over one billion gallons of produced water recycled in the U.S. in the first half of 2022, and its Integrated Water Management Solution already is helping various leading oil & gas companies.

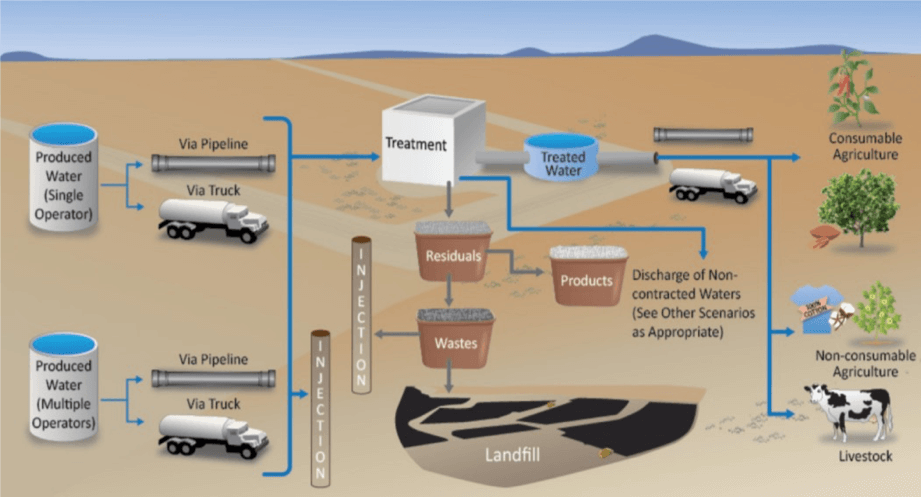

Treating produced water with advanced technologies, like KMX’s, opens new growth opportunities for arid regions and innovative energy companies, as highlighted in Figure 2 below.

Figure 2: Beneficial Reuse of Oil & Gas Produced Water Overview

Source: EPA-New Mexico “Oil & Natural Gas Produced Water Governance in the State of New Mexico – Draft White Paper”

Seismicity Driving Demand for Beneficial Reuse

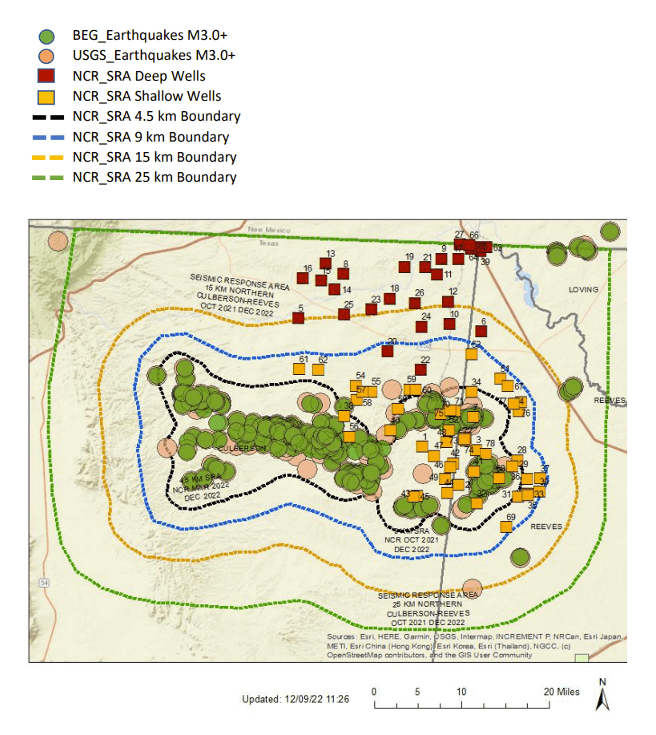

On December 16th, a 5.2 magnitude earthquake occurred in Midland, TX, only one month after a 5.4m earthquake was recorded in Southern Delaware portion of the Permian Basin (spanning Texas and New Mexico, the Permian Basin is the largest producing oilfield in the world).

Most recently, a 3.2m earthquake struck nine miles northeast of Jal (Lea County) on December 27th in New Mexico, which should result in substantial SWD curtailment and pose questions for some of the largest operators in the area.

These high-profile seismic events follow a steady increase in smaller earthquakes in the Permian, which is expected to be a result of continually injecting produced water into SWDs, particularly deeper wells.

SWDs (regulated by the Texas Railroad Commission) are subject to volume reductions within Seismic Response Areas, with earthquakes leading to expanded Seismic Response Area, which curtails injection volumes, slows production, and increases logistical and neighboring disposal costs.

Ultimately, we expect the coming SWD volume reductions and looming permit cancellations to further improve KMX’s full-cycle cost competitiveness versus SWDs, particularly when considering the coming increase in transportation costs to move produced water out of Seismic Response Areas.

We are encouraged that many of the most active and thoughtful operators in the Permian are already developing plans to test and ultimately integrate new technologies into operations to alleviate their dependence on SWDs.

We look forward to continuing to collaborate with TETRA as they introduce KMX’s technology to their customer base at this critical time to save costs, improve water stewardship, and alleviate seismic concerns.

Figure 3: Northern Culberson-Reeves (NCR) Seismic Response Area – Updated Dec. 9th, 2022

Source: Texas Railroad Commission

Opportunity to Monetize Lithium from Produced Water

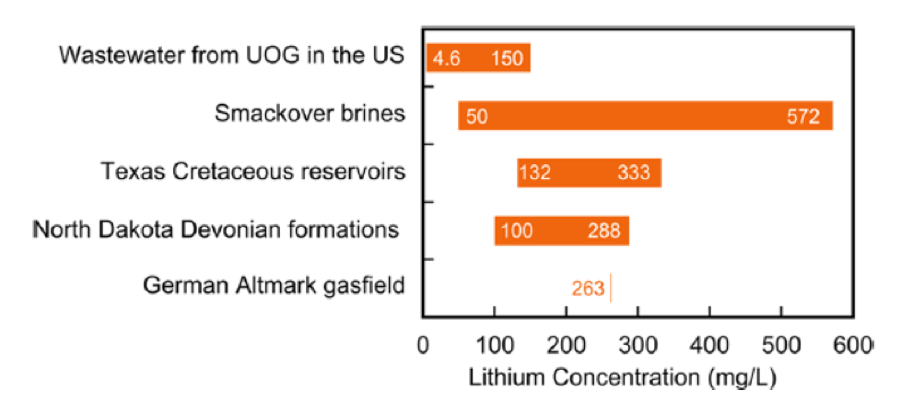

A significant amount of lithium is present across North America in produced water spanning various unconventional basins, as highlighted in Figure 4 below.

As natural gas has moved from an associated waste byproduct to a monetizable commodity for oil producers over the last decade, we expect a similar dynamic to unfold for lithium in produced water which is currently being disposed of in SWDs.

Figure 4: LiCl Concentration in produced water and some oilfield brines

Source: Kumar, Fukuda, Hatton, and Leinhard

Largely, Direct Lithium Extraction (DLE) technologies are ineffective at lithium concentrations below 100 parts per million (ppm), which includes much of the lithium found in produced water.

However, we expect lithium currently trapped in produced water to be unlocked as part of the beneficial reuse treatment process as low concentrations of lithium are increased exponentially in-concert with the desalination process.

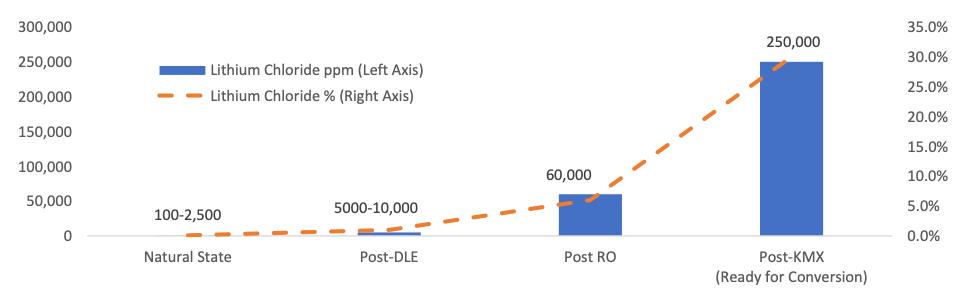

Following the concentration of produced water as part of the beneficial reuse desalination process, lithium chloride can be brought from its natural state to battery-grade lithium, as highlighted in Figure 5.

As a result, we believe the North American oil & gas industry will be a major contributor of lithium and other critical minerals in the coming decades and play an important role in closing the looming lithium supply and demand imbalance, while contributing to the reshoring of the battery and EV supply chain in the process.

Figure 5: Concentration Levels to Battery-Grade Lithium

Source: KMX Technologies

Note: Lithium concentration levels reflect known economically viable brine resources

KMX for Downstream Oil & Gas

KMX is proud to be the water management partner for Meridian Energy Group, which is building the first full conversion refinery in the U.S. in over 40 years.

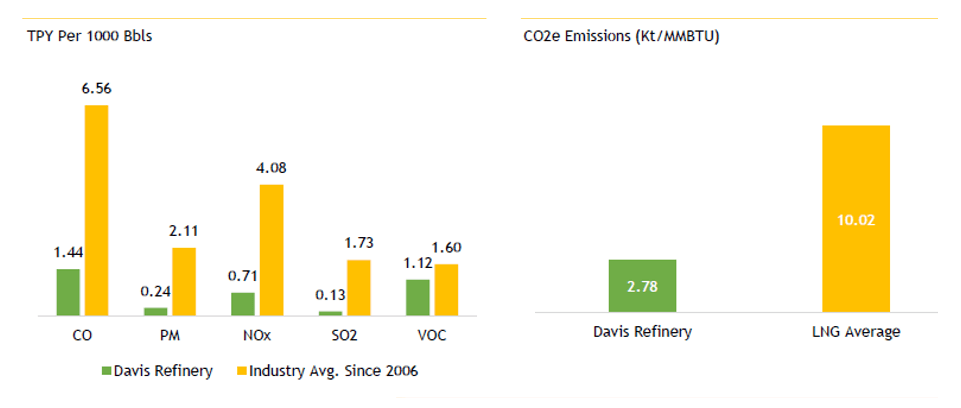

The refinery, a shovel-ready and permitted project in New Dakota, is set to be the cleanest refinery in the world with 1/8th the emissions of the industry average and less than half the industry average for greenhouse gases.

Notably, KMX aims to help Meridian recycle its wastewater to the highest standards and is expected to create higher quality water leaving the refinery relative to the water coming in for industrial processing.

We are excited to help Meridian comply with strengthening environmental regulations and set the standard for the cleanest refinery in the world to ensure liquid fuels are brought to the market in the most mindful way as the energy transition unfolds.

Figure 6: Meridian Energy Group’s Davis Refinery (North Dakota) Emissions Profile

Source: Meridian Energy Group, Company Reports, NDDEQ, Environmental Integrity Project Emissions Database – August 2020

KMX for the Energy Transition – Water, Lithium, Critical Minerals

While lithium concentration remains KMX’s core focus, we are excited to help oil & gas companies improve their water stewardship as the energy transition unfolds, while contributing to energy security and creating new opportunities to monetize unconventional North American lithium supplies in the process.

We are grateful to Paul Cheng and the Scotiabank team for giving KMX the opportunity to highlight our unique technology and its role in the energy transition.

– Zac

Zachary Sadow

CEO

KMX Technologies